Insights from the Compliance Frontline: 50 Top Experts on Overcoming Risk Management Challenges

In the ever-evolving realm of risk management and regulatory compliance, the quest for more efficient, cutting-edge solutions is a necessity. Complok aims to be a beacon in this revolution, introducing an AI-driven risk management platform that not only streamlines compliance but also challenges the status quo of traditional methods. Our recent whitepaper, based on 50 comprehensive interviews with compliance professionals, offers fascinating insights into this dynamic field.

A Sneak Peek into the Whitepaper

Our journey in crafting this whitepaper involved deep conversations with 50 compliance professionals from diverse backgrounds, including large banks, fintechs, and consultancies, primarily from Europe, UK and the Middle East.

These discussions reveal the intricacies of daily compliance tasks, the hurdles and frustrations in managing risk, and the current landscape of risk management tools and the potential for improvement.

Key Highlights

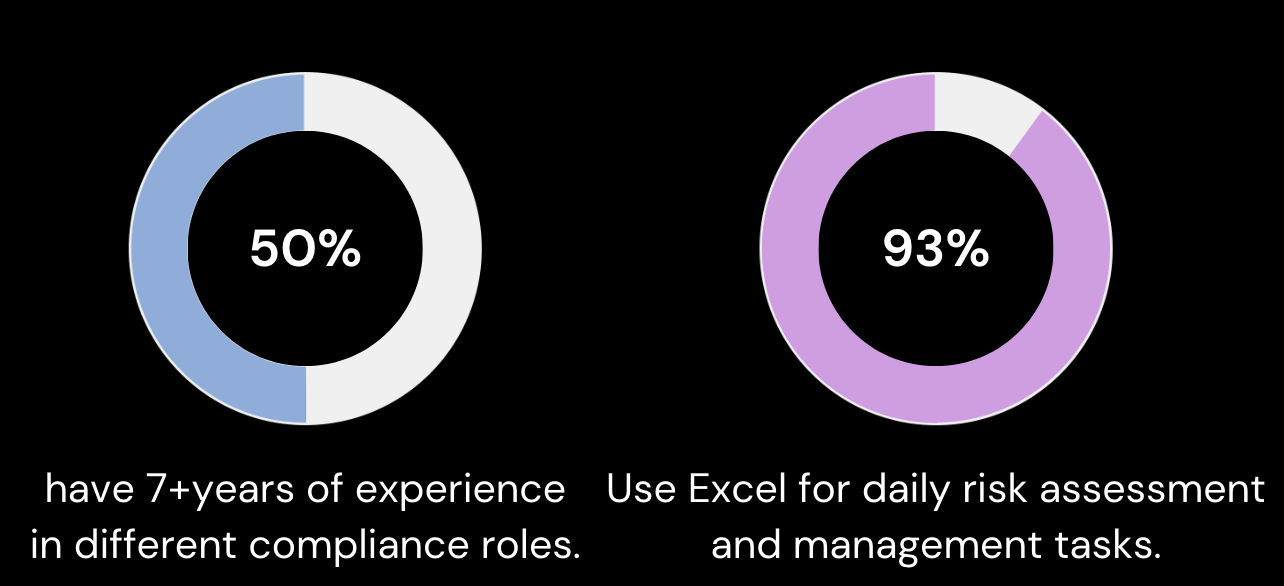

- Experience Matters: Surprisingly, half of our respondents have been in compliance roles for over seven years, indicating a seasoned perspective on the industry's evolution.

- Excel - The Ubiquitous Tool: A staggering 93% of interviewees still rely on Excel for their daily risk management tasks, highlighting a significant reliance on traditional tools.

- Company Size Diversity: Our respondents come from a range of company sizes, with a notable 44% from small companies having 0-50 employees.

Daily Life & Pain Points in Compliance

- A Hectic Routine: Compliance officers often find themselves juggling routine checks and complex problem-solving, bogged down by manual processes and the need to stay abreast of regulatory changes.

- Top Pain Points: These include scattered data sources (18%), repetitive manual tasks (17%), and ever-changing regulations (11%).

Cultural Insights and Time Drains

Time-Consuming Actions: Tasks like data comparison, team management, and dealing with lengthy documents emerge as significant time drains.

Compliance Culture: The attitude towards compliance varies significantly, with larger institutions taking it more seriously, particularly those that have faced compliance-related scandals.

“At [Bank 1] lots of eyes are on the entity - compliance is the gatekeeper of reputation, preventing fines, and following regulations. They have already been hit with scandals. From that point on the culture changed, so people actively sought compliance advice. At [Bank 2], compliance is still seen as that nagging party that always says no, is a true pain in the butt, and is really inflexible. If you can avoid contact with compliance you would from a business perspective.” –Interviewee 23

Automation: The Key to Efficiency

- Trust in Automation: While there's interest in automated solutions, trust remains a pivotal factor, dependent on solution accuracy, data security, and regulatory compliance.

- Barriers to New Solutions: Concerns about data migration, learning new systems, and transition disruptions are major roadblocks to adopting new solutions.

The Ideal Software Solution

Respondents express a clear vision for the ideal risk management software - one that is comprehensive, user-friendly, and capable of automating workflows and generating reports, all while ensuring data security and compliance.

Dreams and Aspirations

Many compliance officers dream of a future where their role is more strategic and less mired in manual tasks. The desire to be role models and contribute significantly to their organizations is palpable.

“I would consider my job a success if I was able to free my team from manual tasks and automate as much as possible so they can focus on strategic decisions and horizon scanning. In other words, be ahead of the game instead of constantly being reactive.” — Interviewee 9

Access the Full Whitepaper

This whitepaper presents a rich tapestry of insights, pointing towards an urgent need for automation and a strong compliance culture in the finance industry. It delves into the everyday challenges compliance officers face, their aspirations, and the potential transformative impact of technology in this field.

Ready to dive deeper into the world of compliance and risk management? To uncover more in-depth analyses and detailed findings, we invite you to download or view the full whitepaper on our website.