Implementing an Effective AML/FCC Enterprise-Wide Risk Assessment (EWRA) Process

In the ever-evolving landscape of financial regulations, the Enterprise-Wide Risk Assessment (EWRA) or Overall Risk Assessment has emerged as a crucial regulatory obligation, particularly from a European Union (EU) perspective. This requirement encompasses various financial institutions, including credit institutions, payment service providers, virtual asset service providers (VASPs), licensed insurance companies, and banking industries, all of which are subject to anti-money laundering (AML) laws and regulations. The EWRA process plays a pivotal role in helping these institutions identify and manage money laundering (ML) and terrorist financing (FT) risks effectively. Moreover, it aids in aligning their risk management strategies with the dynamic standards of the financial corporate world.

Understanding the Significance of EWRA

To establish a robust and risk-based Financial Crime Compliance (FCC) program, institutions must gain a comprehensive understanding of the risks posed by their products, services, delivery channels, customer profiles, and geographic locations. Implementing a transparent and easily comprehensible EWRA process is essential for these institutions. Such a process not only identifies potential gaps within the program but also enables comparative analyses across different lines of business or legal entities. It is imperative to consider regulatory guidelines when conducting an effective EWRA. By taking proactive measures to mitigate these risks, institutions can steer clear of costly penalties and protect their reputation.

Documentation and Updating

One of the fundamental aspects of the AML Overall Risk Assessment is its documentation. This documentation should be maintained and updated regularly, as required by supervisory authorities.. Whenever an event occurs that could significantly impact the ML risk profile of the institution, the EWRA should be updated promptly. This ensures that the institution remains aligned with its risk assessment in the face of changing circumstances.

Process Description

In addition to the EWRA report, institutions are expected to provide a document that outlines the process for completing the assessment. This document should specify the applicable legal framework and sectoral guidance, the methodology employed, and how it has been integrated into the assessment process. It should also describe the procedures for ongoing monitoring and timely updates of the risk assessment process. Furthermore, it should reference the extent to which key stakeholders, including the Anti-Money Laundering Compliance Officer (AMLCO), compliance officers, senior management, and other relevant parties, have been involved at all stages of the process.

An Ongoing Process

It is essential to emphasize that the EWRA process is not a one-time event but rather an ongoing and dynamic process. It must be conducted whenever a significant situation arises that could impact the ML risks associated with the business relationship. At any given time, the institution should have a clear understanding of how its ML risks are evolving within the context of its business operations.

Conclusion

In a world where financial regulations continue to evolve and become more stringent, implementing an effective AML/FCC EWRA process is paramount for institutions in the financial sector. Not only does it help in compliance with regulatory requirements, but it also serves as a proactive approach to identifying and mitigating ML and FT risks. By documenting the assessment, adhering to regulatory guidelines, and maintaining transparency throughout the process, institutions can not only avoid costly penalties but also foster a culture of compliance and risk management within their organizations.

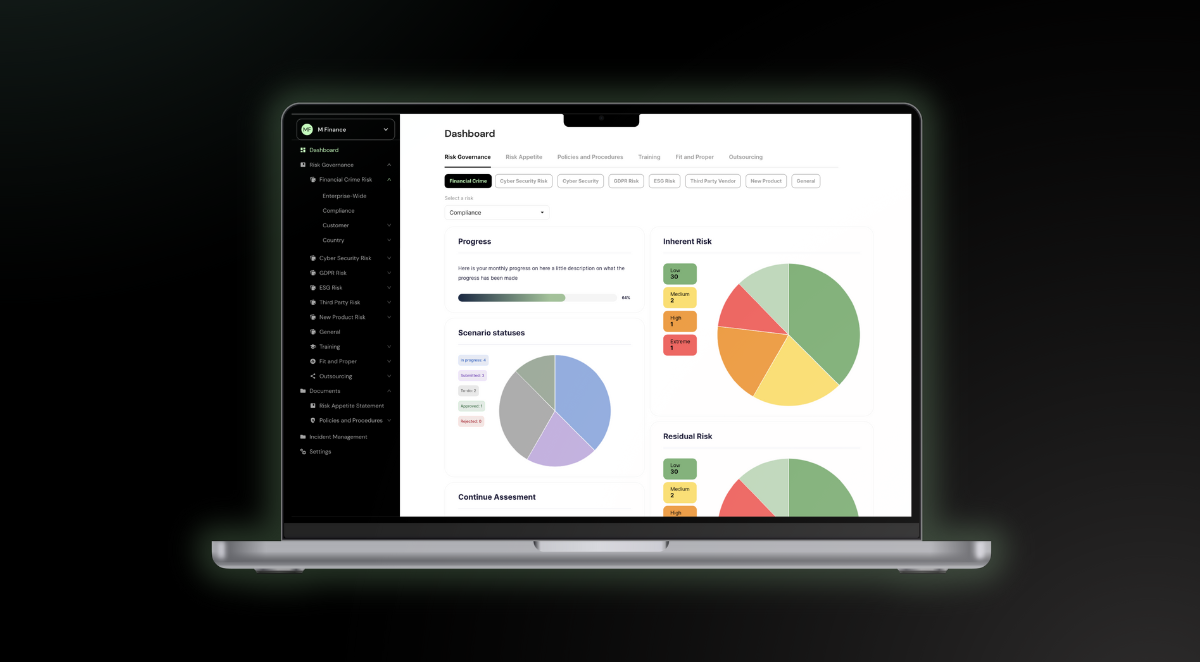

If you require assistance with implementing an effective EWRA process, consider signing up for a demo to our compliance platform to ensure that your institution remains at the forefront of regulatory compliance and risk management in the financial industry.

If you need help with this process please contact us for a demo.